Helping Payers - Both, Private & State Plans

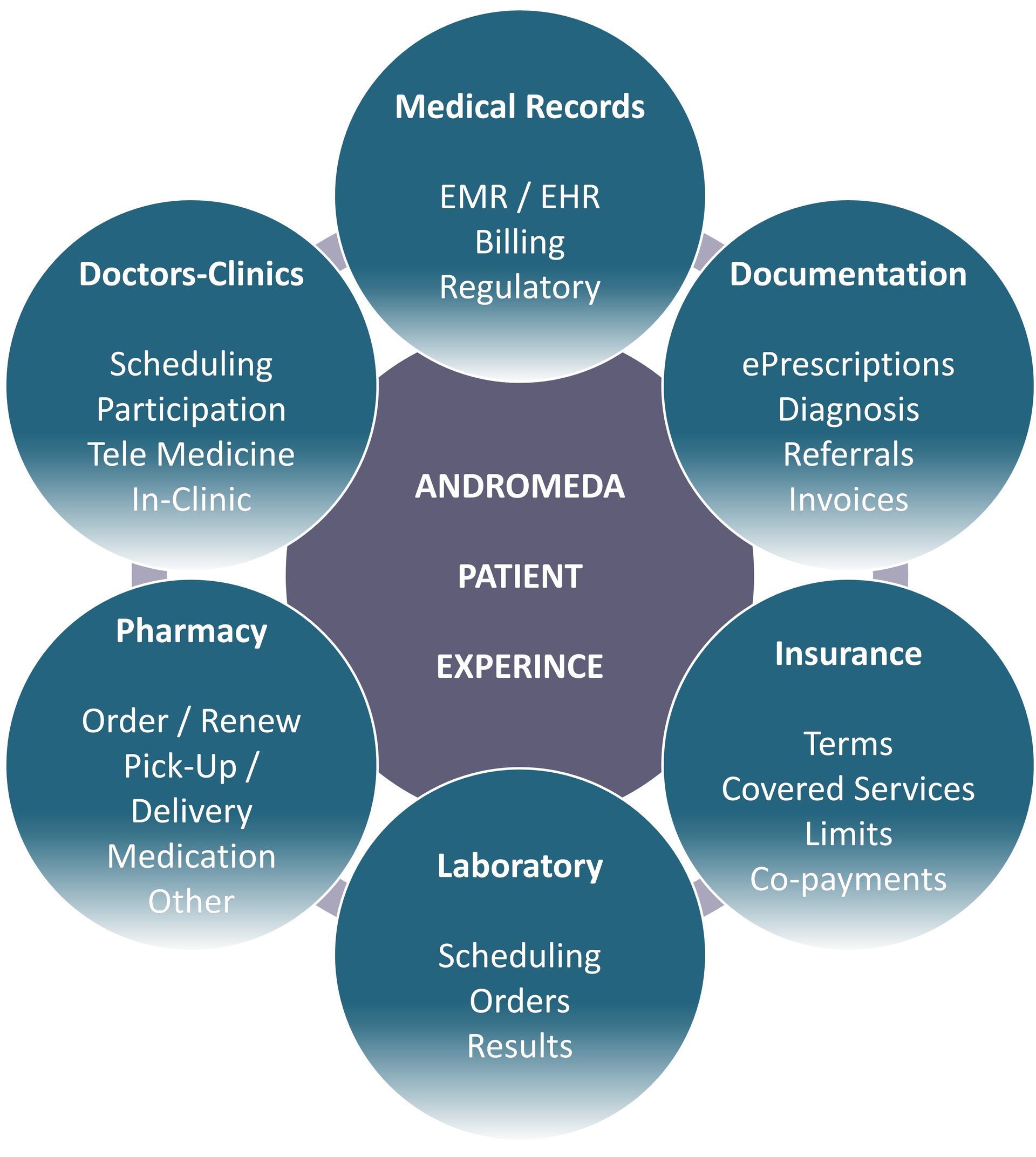

Our platform helps payers / insurance companies organizing the following processes more efficiently at a large scale: payer-provider inter-operability, full enhanced eligibility inquiry, screening programs & early detection of risk groups, patient relationship, medical documentation and their review, billing & claims processing, equity & transparency, policy sales. As a result, quality of service improves, client satisfaction increases and overhead costs decline. While we enhance the patient journey and make it seamless, we help Payers keep the claims ratio / loss ratio low. Platform allows automating processes that are currently mostly manual and human-based, therefore minimizing margin of error.

Payer (Insurance) Value Propositions

Equity & Accessibility

Improved Efficiency

Reduced Errors

Patient Satisfaction

Engagement & Conversion Ratios Grow by 10%-30%

Claims Overhead Costs Reduce By 35%

Instantaneous, Real-Time Access To Medical Claims

NPS / CAHPS Improve by 10-30 Points

We Bring Efficiency, Inter-Operability & Power Analytics

You Capitalize On Improved Service Quality And Reduced Costs

Improved Inter-Operability, Patient Service Quality & Reduced Costs

We connect everyone in the healthcare ecosystem, automate support & administrative processes and allow payers / insurance companies (both, private and state plans) to:

- Digitalize and automate full eligibility inquiry at admissions, opening medical case / claims and their review

- Have instantaneous access to each medical case and claim, upon its very inception and follow it online, in real-time

- Start claims processing & analysis earlier, when the event originates, and follow it in real-time vs having the same information at a conventional weekly or monthly billing cycles, post-factum, when the case is completed

- Reduce average review time per medical case / claim

- Significantly reduce workload on call centers and back office

- Reduce claims processing overhead & administrative costs

- Obtain full analytics on medical cases, billing and claims, to improve claims ratio and improve provider relationship

- Reallocate released time & resources on sales and underwriting

- Reach out patients / subscribers directly, through pushing follow-up meetings in the system, or through direct messenger communication or direct in-app video communication

- Enhance screening programs to allow early detection, lowering clinical risks and treatment costs

- Reduce claims ratio / loss ratio

Shorter Medical Case Access Time & Claims Review Time

- Instantaneous, real-time access to medical cases

- Full digital review of medica cases

- Real-time, digital approval of pre-authorizations

- Shorter time needed for claims review and processing

- No time required on analytics

Significantly Improved Client / Patient Satisfaction

- Uninterrupted and seamless user journey

- Super convenient and easy-to-operate user interface

- Transparent environment with best-in-class search and compare features

- NPS / CAHPS significant growth

Securely Storing & Reviewing

Documentation

- Medical records

- Lab test results

- Radiology results (images)

- Insurance documentation: insurance policy & plan details, provider lists, services & tariffs, minimal spend & co-pays, pre-authorizations, approved or rejected claims, etc.

- Billing documentation: invoices, paychecks, etc.

Financials, Costs & Revenues

- Increased private insurance sales and Medicaid premiums due to increased NPS / CAHPS

- Decreased claims ratio / loss ratio due to reduced human errors and early access to medical cases

- Free online brokerage: lifetime, no-fee sale of insurance policies in the platform & app

- Reduced overhead costs on billing processing, claims processing, patient interaction and policy sales

Electronic Workflow, Pre-Authorizations & Claims

- Automatic approval of standard pre-authorizations

- Instantaneous review and approval of non-standard pre-authorizations

- Online, real-time review of prescriptions, referrals, medical case

- Telemedicine integrated

- In-app interaction with patients

- Online review and approval of claims and refund requests

Prescriptions, Medications

In-Store Eligibility Inquiry

- Enhanced eligibility and plan inquiry inside pharmacies & drug stores

- Access patients' ePrescriptions and there adherence reports

- Unique medication substitution algorithms

- Fully automated monitoring of adverse drug reactions & adverse drug events

For More Information and Demonstration

Inquire Today

Thank you for contacting us.

We will get back to you as soon as possible.

Please try again later